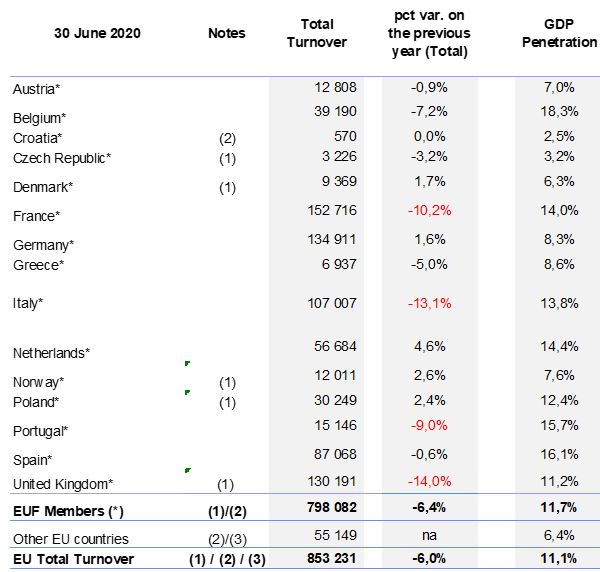

Data gathered on the European factoring market for H1 2020 has shown, for the first time in 11 years, a decrease in factoring turnover of 6.0% year on year. The total factoring turnover reached €853 billion compared with €911Bn in H1 2019. Information received from country members’ organisations indicates that this drop is principally the result of national lockdowns, and in some countries of the impact of government measures to sustain enterprises and especially their treasuries.

What is interesting is that the decrease in factoring turnover was almost in line with the reduction in EU GDP of 6.3%. This is why this year’s GDP penetration ratio was similar to last year’s (11.1% compared with 11.2% in 1H 2019); normally we see factoring growing faster than GDP.

The trend differs between countries, but 3 of the top 5 European factoring markets were the hardest hit.

The biggest falls were observed in:

- UK, with 14% decrease year on year, significantly greater than its GDP reduction of 7.7%,

- Italy, with a 13% decline, whilst GDP shrunk nearly 11%,

- France, with a 10.2 % fall, compared with a 9.3% reduction in GDP,

- Portugal, (not the one of the largest markets) fell 9%, and GDP reduced 7.1%,

- Belgium with a 5% turnover reduction and an 8% decrease in GDP.

The principal causes of these reported falls were:

- decreased client turnover,

- insufficient, poorly targeted or belated government interventions.

Despite this difficult environment, there were also countries where a yearly increase was reported:

- Netherlands, where turnover grew 4.6%, when GDP decreased by 2.6%,

- Norway, which saw 2.6% of growth, when it experienced an almost 13% decrease in GDP,

- Poland, which grew by 2.4% whilst its GDP fell by 2% (although if we exclude the increase in turnover of one main member, the overall market decreased by 2%, in proportion to the GDP decrease),

- Denmark, 1.7% growth against 2.6% GDP reduction,

- Germany 1.6% growth compared with a 4.2% fall in GDP.

Information from the German and Polish markets indicates that in both these countries the support measures taken by their governments has helped to soften the economic impact of lockdown and to minimize its effect on the supply chain.

The leader of the European market is France with almost 18% of the market. Next are Germany with 15.8%, UK 15.3%, Italy 12.5% and Spain 10.2% respectively. These top 5 countries represent 71.7% of the EU factoring market.

Françoise Palle-Guillabert, Chairman of the EUF, noted: “Beyond the headline figures, this is an unprecedently challenging time for all of us. The international Covid-19 pandemic is shaking the whole world and the impact on our economy is even tougher than the 2008 financial crisis. Since the beginning of the pandemic, the EUF has been in close contact both with the European Union economic authorities, and with its European sister federations, in order to review and soften some regulations - such as the New Definition of Default, the Non-Performing Loan, EBA Guidelines on Loan Origination and Monitoring - and thereby seeking necessary and appropriate support for business. More than ever, and especially in the context of all the state supporting plans that have been put in place, the factoring industry has a key role to play in sustaining economic recovery, employment and wealth creation in Europe”.

ENDS 21.09.2020

Notes to Editors

The EUF is the Representative Body for the Factoring and Commercial Finance Industry in the EU. It comprises national and international industry associations that are active in the region. Its members and partners represent 97% of the Industry turnover.

The EUF seeks to engage with Government and legislators to enhance the availability of finance to business, with a particular emphasis on the SME community. The EUF acts as a platform between the Factoring and Commercial Finance Industry and key legislative decision makers across Europe, bringing together national experts to speak with one voice.

Data has been adjusted to ensure that currency exchange rate fluctuations do not distort the results.

For more information and full data analysis:

See our website: www.euf.eu.com

Contact info@euf.eu.com louismarie.durand@euralia.eu